Kian Ghazi of special-situations research firm Hawkshaw LLC likes to look for investment ideas in which there’s clear “tension,” by which he means there are logical hypotheses both for why a company’s stock is a potential short and for why it’s a potential long. General consensus, the thinking goes, will rarely result in mispricing.

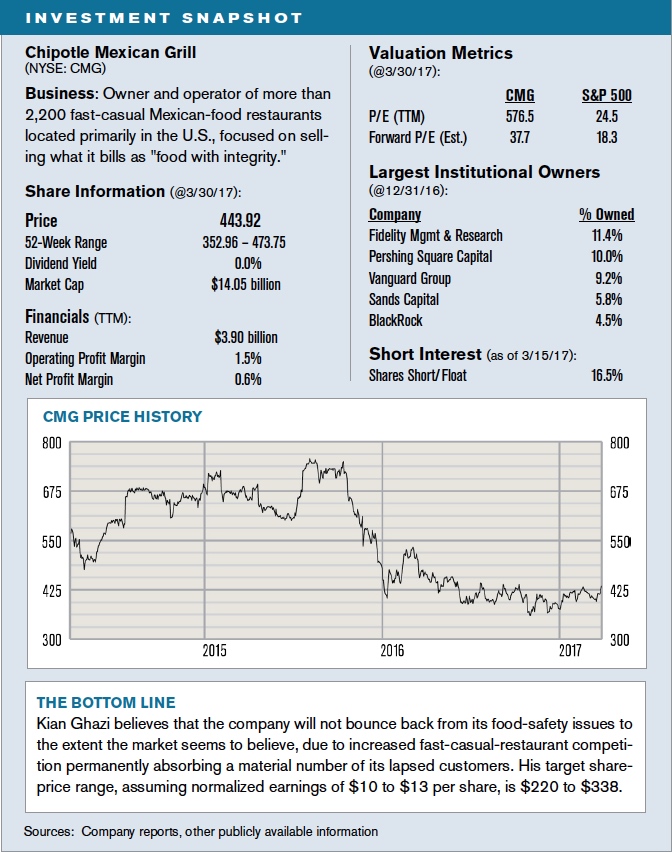

Tension he found late last year while digging into Chipotle Mexican Grill, the fast-casual restaurant chain that had gone from hero to goat in the market’s and customers’ eyes after a string of highly publicized foodborne-illness incidents at its U.S. restaurants in the second half of 2015. Even though its once high-flying stock price had fallen from mid-2015 highs of nearly $760 to well below $400, short interest in the stock was still stubbornly high. At the same time, well-known investors – most prominently Bill Ackman’s Pershing Square Capital – had established large long positions. Tension appeared sufficiently intact.

Ghazi's initial inclination was that the stock was likely a buy rather than a sell: “You had a company that was a leader in its space, that was still generating good returns on capital, that had been hit by the type of challenge that in similar situations historically tended to fade away, with a stock that was cheap if you believed the company could resume its growth and come anywhere close to its historical operating metrics," he says.

As he proceeded with his research he came across some early warning signs. Roughly a year after the crisis peaked, fourth quarter 2016 sales per restaurant – despite heavy advertising and promotional spending – was still running 20% below prior levels, and the speed of recovery in such sales was materially slower than had been the case in previous food-safety outbreaks at Jack in the Box, Taco Bell and KFC China. In addition, Chipotle's brand-trust and food-quality scores based on survey information from Technomic’s Consumer Brand Metrics database remained well below historical levels and showed little evidence of recovering. Finally, Google searches using the word “Chipotle” that were unrelated to food safety – searches that likely indicate a desire to order online or to find a location to eat – fell sharply after July 2015 and not only hadn’t recovered, they continued to decline.

The picture didn't get brighter as he started speaking with unpaid, independently sourced industry executives who, for example, previously worked at the company or who currently led private competitors. From those conversations he came to learn that consumers’ lunch patterns tend to be habitual and that it would likely be much harder for Chipotle to recover lapsed customers who had formed new habits with the expanding base of fast-casual competitors. That competition was greater in markets along the coasts than in middle America, which was consistent with the fact that Chipotle was suffering greater sales declines on the coasts than elsewhere. Four of the five executives of privately held fast-casual competitors with whom he spoke suggested that their same-store sales were under pressure in those same markets, which they attributed to increased competition that was unlikely to abate.

Bulls are hoping that the company's average unit revenues will approach their pre-crisis highs, but Ghazi thinks AURs will stall at 15% or so below peak levels. He assumes increased food-safety and promotional expenses will represent a permanent 350-basis-point or so drag on restaurant-level margins going forward. He also expects the company’s historically high returns on invested capital to fall to the mid-20% range, in line with strong competitors like Panera. While he builds in modest price increases to help offset labor and other cost increases, he believes the company’s pricing power isn’t what it once was given the lingering hit to its reputation – a hit more difficult to overcome because the issues setting off the crisis directly challenged the company's "food with integrity" branding.

ON REPUTATION:

The hit may be more difficult to overcome because the issues challenged the firm's "food with integrity" branding.

Add it all up and he believes the company on a normalized basis will earn $10 to $13 per share. With lower margins and lower ROIC’s, he expects normalized valuation levels also to fall more in line with companies like Panera, which has traded in a 22x-30x P/E range over the past five years. At the low end of that valuation range on $10 per share in earnings, the stock would trade at $220. At the midpoint of the range on $13 per share in earnings, it's a $338 stock. The share price today: $444.

Key threats to the bear case? While some bulls believe that Chipotle has untapped international growth potential, Ghazi is skeptical given that there are only 12 European stores today, seven years after the first was opened in London in 2010. His discussions with former Chipotle executives indicated that the European stores are uneconomic because of significantly higher operating costs. More problematic to his thesis would be tax reform that features lower corporate rates, a boon to the company given that its current tax rate is just under 40%. He is also closely watching the brand-trust and Google-search data for early signs that customer sentiment is becoming more positive, which could signal an improved recovery.

The nightmare scenario for Chipotle – impossible to handicap – would be if the food-safety issue reared its ugly head again anytime soon. Says Ghazi: “If it happens again, it will be very, very damaging for the company.”