Talk to any value investor as the coronavirus pandemic roils the market and the first message is often about the importance of a company's resilience. In an indiscriminate selloff, firms more resilient in the face of tumult are highly likely to provide incremental investment opportunity.

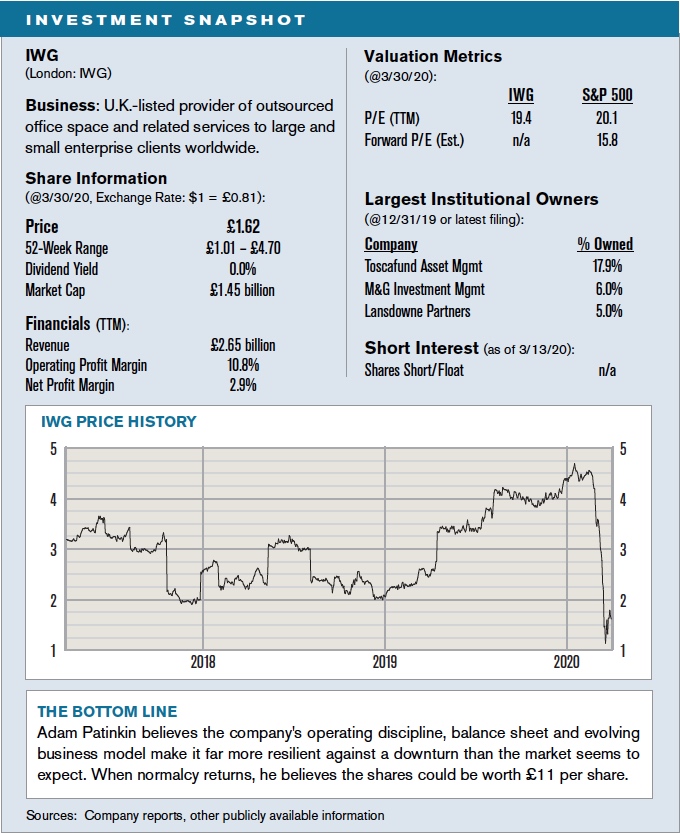

Adam Patinkin of David Capital Partners believes that’s the case for Swiss-based IWG, which he calls a “better-run, more profitable, and much-larger version of WeWork.” Founded in 1989, the company operates 3,500 locations in 121 countries, providing flexible office space and related services for more than 2.5 million workers per year. Many work for small firms, but Patinkin says the main growth driver has been large companies increasingly outsourcing the management and operation of office space. An IWG client like Nokia, for example, has employees distributed across 170 IWG sites in Europe and the Middle East, offering workers professional work environments, state-of-the-art technology and shorter commutes. For multinationals requiring partners with global footprints, IWG alone has the requisite scale.

Fallout from the coronavirus will temporarily throw a wrench into even the best-laid plans, but Patinkin believes the company is far more resilient than the market seems to believe. It can exit 95% of its office leases in six months or less. All of its locations are individually incorporated, so trouble in one area doesn't hurt the entire company. He says IWG’s cash flow actually increased in past recessions as it cut capital spending and won rent reductions from landlords that were then passed on to tenants to help maintain occupancy. In 2009, for example, IWG’s occupancy fell less than 5%. With modest debt, £700 million of cash on hand and the potential to generate £400 million in free cash flow over the next 12 months, Patinkin believes the company is likely to improve its competitive position through a downturn – again, as it has in the past – by buying distressed competitors.

When economic normalcy returns he also sees a strong upside catalyst for IWG’s stock in its refashioning of its business model toward franchising separate geographic locations to “master franchisees.” The company has concluded six transactions so far – including in Japan, Switzerland and Taiwan – with new franchisees paying an average multiple of 3x revenues. If the company were to franchise its remaining £2.7 billion in revenue at a similar valuation, the resulting take would be £8.1 billion, or £9.20 per share. Adding the value of the high-margin franchisor business that would remain, Patinkin estimates IWG's shares would be worth close to £11.00 per share. The current share price: around £1.60.

"We see here a strong and resilient business that is built to survive and thrive, while the market has priced in something else entirely," he says. "That creates opportunity." IWG's leadership would seem to agree – its CEO and other board members have purchased more than £10 million in stock in the past two weeks.