Value investors, like moths to a flame, pay careful heed to news events that cause negative market reactions. That’s especially true when they respect the company whose stock got hammered and when their initial take is that the news is actually positive rather than negative. Even better is when the CEO of the maligned firm steps in to buy shares on the dip worth more than $46 million for his personal account.

That exact setup attracted the attention of Joseph Boskovich Sr. of Old West Investment Management to Abbott Laboratories stock last year. Within a month of the company’s April announcement that it would pay $25 billion to acquire device-maker St. Jude Medical, Abbott’s shares had fallen nearly 15%. That was despite the company’s strong track record in creating value through mergers and acquisitions. When Abbott’s CEO of 17 years, Miles White, made his open-market purchases, Boskovich dug much deeper. “When a long-tenured and successful CEO makes a purchase of that size there’s really only one thing on his mind – he thinks the stock is going to go much higher.”

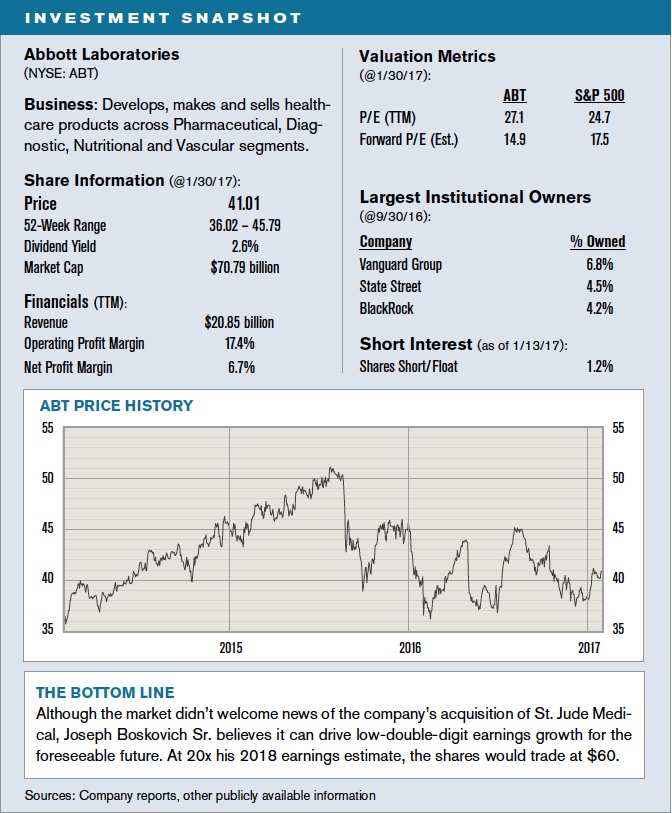

Abbott sells an array of healthcare products through four divisions: pharmaceutical, diagnostic, nutritional and cardiovascular. This last division will be significantly enhanced with the merger, as St. Jude’s devices add complementary strength in such areas as heart failure, arrhythmias and vascular disease. The entire cardiovascular-related market is expected to grow significantly as the world’s population ages – in the U.S., for example, more than 40% of adults are expected to suffer from some form of cardiovascular disease by the year 2030.

Abbott ended up paying about 20x estimated 2017 earnings for St. Jude – the deal closed earlier this month – a multiple Boskovich considers entirely fair given the business’s stand-alone growth prospects and the potential for revenue and cost synergies from the merger. With mostly complementary but not directly competing products, he sees considerable potential for cross-selling to each company’s customer bases, and he believes $500 million can be taken out of R&D and selling, general and administrative costs by 2020.

While many healthcare companies face pricing pressures, Boskovich believes Abbott’s pricing and profit margins are already fair due to competition from Boston Scientific and Medtronic. He also expects the FDA to be more collaborative under the new administration.

At a recent $41, Abbott shares trade for 13.7x Boskovich’s $3 2018 EPS estimate. That’s far too cheap, he says, for a proven, well-managed company that is integrating an acquisition that he believes can drive low-double-digit earnings growth for the foreseeable future. He considers a 20x multiple fully warranted, which if he’s right on earnings would result in a $60 share price. A positive outcome for all shareholders – including CEO White, whose purchases last year were made at around the current share price.